Morocco

The Anchois Gas Development Project

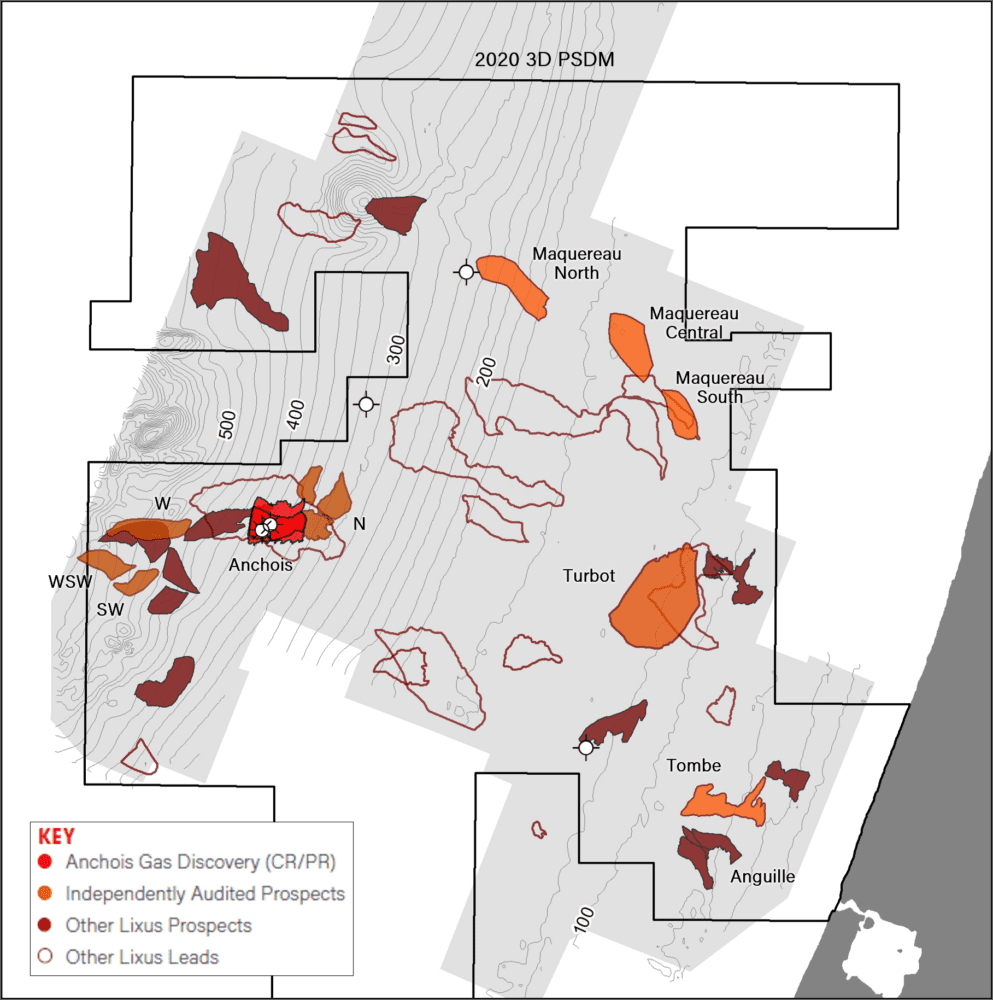

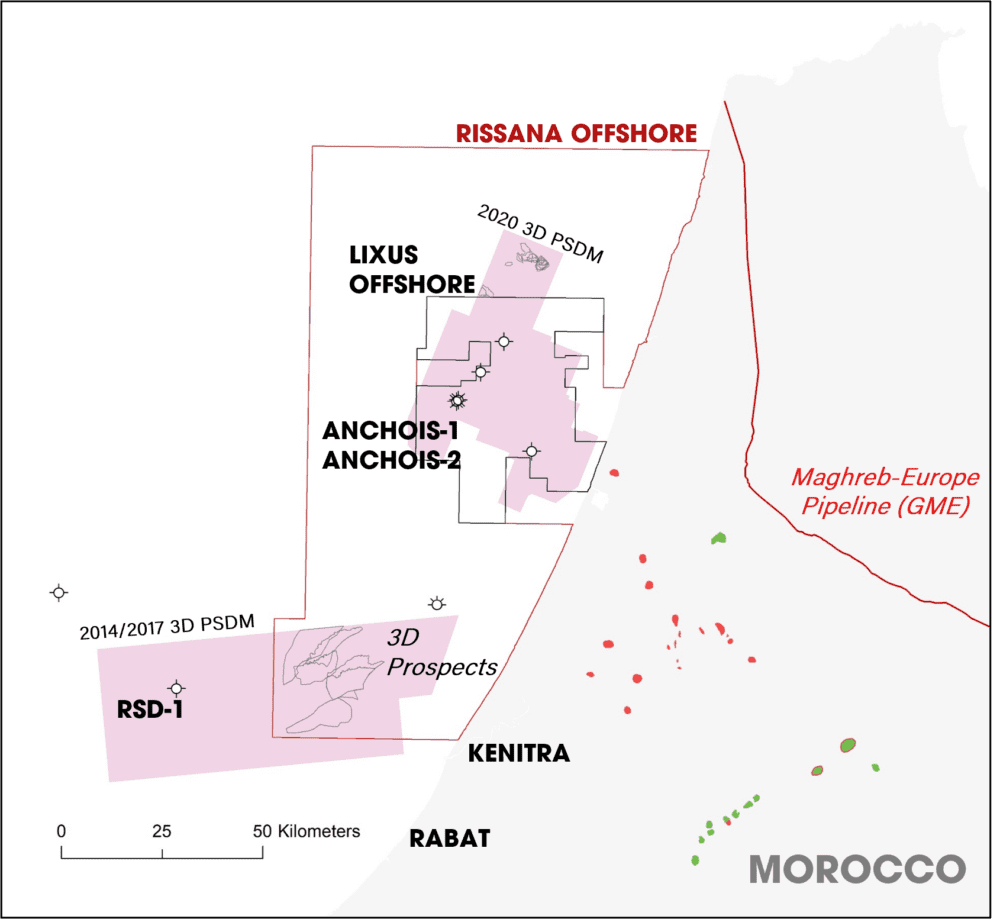

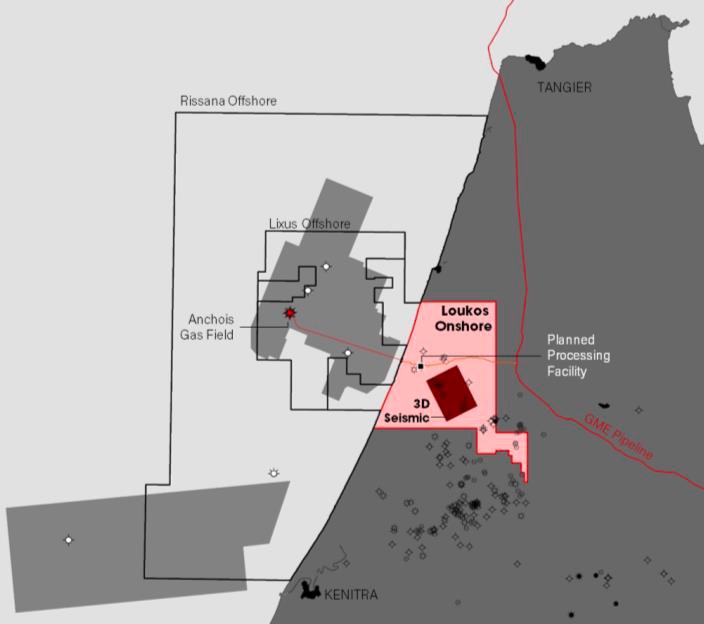

The Lixus Offshore licence covers an area of approximately 1,794km², with water depths ranging from the coastline to 850m. The area has extensive data coverage with legacy 3D seismic data covering approximately 1,425km² and 5 exploration wells, including the Anchois-1 and Anchois-2 discovery wells.

The Anchois gas discovery represents a high value gas appraisal and development project.

- Anchois-1 gas discovery – previously audited total remaining recoverable resource in excess of 1 Tcf, comprising 361 Bcf 2C contingent resources and 690 2U prospective resources.

- The appraisal and exploration well, Anchois-2, drilled safely, on time, and on budget, discovered excellent quality, dry gas across seven reservoirs with approx. 150m net pay.

- Updated Independent Assessments made in 2022 provide material increase in resources for the Anchois Gas Field, which now stand at 637 Bcf 2C contingent resources and 754 Bcf 2U prospective resources.

- High quality reservoir properties that mean producer wells can produce gas at high rates, reducing the associated drilling and completion costs and subsea complexity.

- Excellent gas quality, without impurities such as carbon dioxide or hydrogen sulphide, means that standard materials and technology can be used for the flowline and processing facility

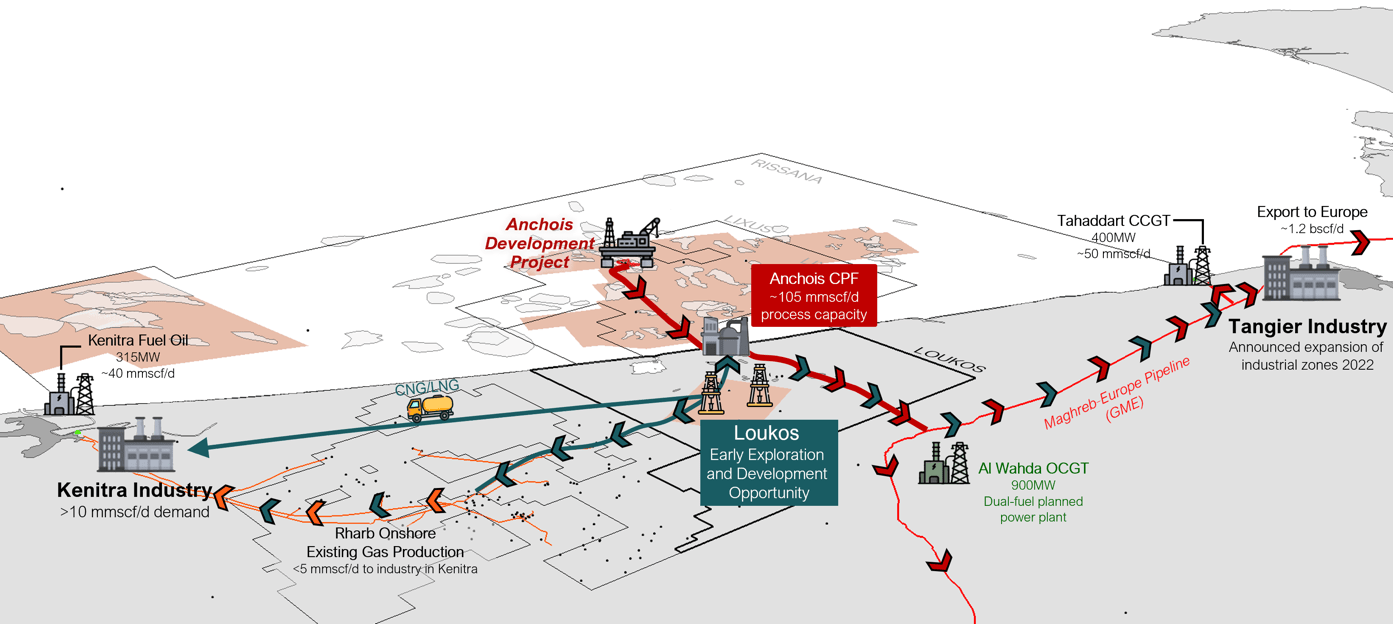

- World-class commercial contract terms with high gas prices in a developing market with growing energy demand offers a potentially high-value project

- Project financing for the development of the project to be led by notable investment bank Societe Generale

- Reservoirs are directly imaged on seismic data, with distinctive seismic signatures, showing bright, high amplitudes and far-offset (AVO) seismic anomalies, increasing the confidence in the lateral extent of the sands away from the discovery well location and other systems on-block

- Material low risk exploration satellites with significant tie-back potential

- Additional on-block exploration upside of >4.5 Tcf